2021- What a year it's been

There’s no question 2021 has been one of the biggest years ever in crypto! From the rapid rise of Binance Smart Chain and Solana, along with various alternative L1s AKA the “ETHkillers”. Avalanche, TerraLUNA, Cosmos, Algorand, Fantom, NEAR protocols to name some of the bigger ones, as well as some old names like Cardano are still hanging around the top 10. Polkadot continues to fly under the radar, some might even say underperform if just looking at price, but long term the prospects are encouraging with parachains beginning to launch.

A multitude of DeFi options continue to evolve and be built across various blockchains. Lending, borrowing, staking and derivatives, are all accessible to the masses in a decentralized fashion. On Ethereum one of the persisting issues of using these in 2021 has been the high cost of gas fees. This has been prohibitive to users, and expedited the rise of some of the other L1s offering cheaper and faster TXs.

However, as they're still relatively early and the blocks aren’t full, we don’t have the full picture of how those L1s will scale. Binance Smart Chain suffers delays during peak times. Solana has gone down multiple times due to DDOS attacks. On Ethereum L2 solutions such as Optimism, Arbitrum, Boba and Metis have finally begun their rollout. Rollups represent the future of Ethereum, with cheaper gas fees and higher TX throughput all while still leveraging the security of ETH layer 1.

Bitcoin started 2021 at new ATHs around $30K USD, then steadily rose to almost $64K by mid-April. A few weeks later in May, we experienced two major Black Swan events. Elon Musk would question the energy efficiency of BTC and backtrack on talk of Tesla accepting it as payment. China decided to enforce a ban on crypto, forcing Chinese miners to pack their bags for more favorable locations from Kazakhstan to Texas.

Why China's bitcoin miners are moving to Texas - BBC News

This all led to a huge dip, all the way back down to the $30K level, but considering we’d never even seen a $30K Bitcoin before 2021, let alone $60K, those able to see through the FUD had many reasons to remain positive on how far we’d come since the last bull run in 2017.

In June we had the first country adopt BTC as legal tender, with El Salvador passing the “Bitcoin Law”. The law went into effect by September, with President Nayib Bukele buying dips along the way, and receiving much support from Bitcoin maxis on Crypto Twitter(CT). But also many criticisms, from the functionality of the state sponsored Chivo app, all the way to legacy institutions like the IMF, and even Vitalik Buterin chiming in:

Vitalik Buterin: El Salvador's Bitcoin Approach Is 'Contrary to the Ideals' of Crypto - Decrypt

We went more in depth about El Salvador in our recent post:

Origins of Trade and the Current Financial System (substack.com)

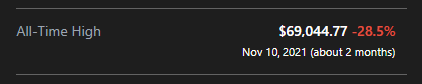

Those who HODL’ed and DCA’ed through the summer months would be rewarded for their faith, when in classic meme-like fashion Bitcoin would recover to new ATHs above $69K by November. This was exciting, but the price would drop again and has recently ranged between $45K and $52K since. Despite never seeing these prices before 2021, many were still disappointed…especially those following PlanB’s stock to flow model which predicted a $98K BTC by November.

All of which leaves us with currently uncertain market conditions headed into 2022.

Stay Safe

With an uncertain market and global landscape when considering the ongoing pandemic and new Omicron variant, we do want to touch on a sad but supportive topic.

I’m reminded of the unfortunate story from 2020 of a young Robin Hood app user who looked to be down $730,000 USD in a complex options trade. He had tried to contact customer support but received only an automated reply, and then went on to commit suicide. To make matters worse, the trades he was involved in were of a type taking days to settle and displaying temporary balances, so he wasn’t actually in debt for that amount after all.

If he was able to wait it out, consult with customer service or family and friends, there would have been better solutions available. The family filed a wrongful death suit against Robin Hood which was settled earlier this year, and the company now offers 24hr phone support including suicide prevention services.

Robinhood Has Settled a Suit Over Suicide of a 20-Year-Old Trader (businessinsider.com)

With that in mind we urge you to regularly communicate on any problems, financial or otherwise. Even when mistakes happen or tough market conditions persist you need to be willing to talk about things and seek out solutions to overcome whatever was holding you back.If you’re a trader then be especially careful with leverage. There are other more fundamental ways to approach your crypto enterprise on your Path to Crypcadia.

Look Ahead 2022

With these opportunities in mind we’re big here at Crypcadia on the future of L2s, as well as the Big Merge which should happen around June latest. Ethereum was built to scale, but it ‘s taking time to do it in a fully decentralized way.

Noted Bitcoin maxi Jack Dorsey stepped down as CEO of Twitter, and he’s always said he would focus on working on Bitcoin if he were to leave. It didn’t take him long to stay true to his word, as payment platform Square immediately renamed to Block in order to reflect increasing blockchain focus going forward. He also tore into CT questioning the definition of Web3 and how different it is from the VCs in the Web2 world he’s been living in for so long.

We can expect further institutional adoption, but whether we get our first USA spot BTC ETF or not is totally up in the air, as the SEC, led by Gary Gensler, has shown strong opposition to spot offerings.

Politicians seem to be coming on board more and more globally, aside from El Salvador, many cities including Miami and New York elected mayors with pro-crypto policies, launching city coins and taking their salaries in BTC. Even state Senators are becoming publicly more pro-crypto as well, such as Pat Toomey and Cynthia Lummis.

The case for new regulations covering stablecoins and CEXES seems likely to gain traction in 2022. Tether still has many question marks lingering on it’s exposure to commercial paper and possibly Chinese real estate. But USDC has closer relations with regulators in the US and through the Circle/Coinbase partnership.

Read our recent report on stablecoins here:

Even Binance, the largest CEX has finished the year announcing regulatory progress and new entities in Dubai, Bahrain, Singapore and Canada. We’re still waiting on an official announcement for their global HQ.

Binance had been focused more on their global business, keeping regulators at arms length and the new announcement shows a change of direction in Binance’s approach. Meanwhile Coinbase and FTX have been more willing to work with regulators in order to gain traction in the US market.

Coinbase, FTX, and Crypto.com continue their heavy marketing campaigns in sports especially in order to grow their brands and user base. Most notably, Coinbase's sponsorship deal with the NBA, and naming rights deals for Crypto.com Arena in Los Angeles and FTX Arena in Miami.

NBA lands first cryptocurrency sponsorship with Coinbase (cnbc.com)

Countries large and small are taking a serious look at CBDCs in order to maintain control over the monetary system since the emergence of decentralized cryptocurrency. This was a prime factor in China’s crypto ban, and nations large and small are considering their use. Ripple has a CBDC pilot project in Bhutan in the works, and if they ever settle their suit positively with the SEC in the US then watch out for the XRP Army!

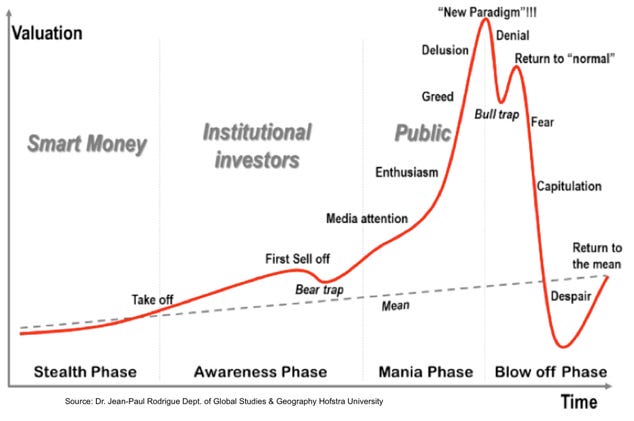

There is always the prospect of a bear market on the horizon. What form this takes is as yet unclear. Will there be a major crash, or with more institutional and retail investors involved in the markets have we turned a corner on the usual patterns based arond the BTC halving events. Have we already witnessed a double bubble in 2021? Only time will tell for certain.

Regardless of what happens in 2022, bull or bear market, the Prophets of Crypcadia are regularly mining new CadiaGems to guide and support you. We’ll be there with Cryptoverance to accompany you along the way and will continue with ongoing analysis.