DemistiFi Liquidity

Ethereum DeFi 2

Born from the vision of financial freedom that began when we were children we present to you Crypcadia. There has always been an energy inside that kept pushing us to improve and become successful. All we ever wanted was the chance for a wonderful life and fair opportunity to achieve this. We call our passion Cryptoverance and it’s what is required to reach Crypcadia.

It’s the passion to not only help yourself but also your family and friends so they too can find solutions for what they want to achieve. Along the way everybody will need knowledge. So we provide you with CadiaGems. Curated crypto knowledge that will educate you on what’s required to succeed on the path to your ultimate destination.

Ethereum DeFi 2- DemistiFi Liquidity

On our previous introductory DeFi tour, we gave you a taste of some of the more common aspects of the decentralized finance universe. This time we’re going to take a longer look at some of those subjects to help you develop a deeper understanding.

We’ll be telling you what to watch out for and also be sharing 3 CadiaGems that you can use to position yourself in the best possible way to make money from LPing

It’s important to remember that just as you may be new to these concepts- cryptocurrency and DeFi themselves are still in their early days too. As we grow together with collective Cryptoverance, new solutions and ways of achieving things will arise.

We mentioned DEXs (Decentralized Exchange) as one of the most important concepts in DeFi. Enter Uniswap. This Ethereum based Automated Market Maker (AMM) DEX paved the way for a wave of similar swap DApps. SushiSwap, PancakeSwap, and many other food themed swaps took their code from the originator Uniswap in what were termed vampire attacks. If there are enough requests we’ll be happy to tell you more about the exciting events of the past!

But as mentioned before, we’ll stick to the Ethereum based DeFi ecosystem since it hosts the originators in the space. You can then apply your knowledge cross-chain more easily once you understand the basic concepts.

Remember we said that DeFi allows you to BYOB - be your own bank. In order for the bank to operate, it of course needs some funds, in this case crypto such as ETH or DAI. Part of being your own bank is not just controlling the storing, sending and receiving of the crypto in a wallet, but there’s also the opportunity for using the more complex banking functions which are available.

DEXs like Uniswap have been created so transactions can automatically be executed according to the needs of the user. This allows you to trust (the code), in a trustless and permissionless system. You trust, or rather don’t need to trust, as long as the code is done correctly, instead of trusting an organization and it’s people with your finances. You don’t need permission or approval from anyone to use the system, as there are no background checks or lengthy approval processes.

In this case you may opt to be a “Liquidity Provider” (LP) and perform the traditional function of market making by providing your crypto funds into a pool as liquidity for others to trade through. On AMM DEXs like Uniswap, there is no classic laddered order book which would be too slow (market fluctuations) and expensive (gas fees) to process on chain.

You could still opt to use a traditional order book for trading on a CEX like Binance, Coinbase, etc. but it won’t be decentralized, permissionless, and censorship resistant. There are also new central order book solutions coming out on Solana and Eth Layer 2’s, which we’ll tell you about in a future edition!

But for now to experiment with Liquidity Pools, the support system on which an AMM DEX is built, you’ll just need some crypto in your wallet, such as Metamask, TrustWallet, or you can find a list from the Ethereum Foundation here: Find an Ethereum Wallet | ethereum.org

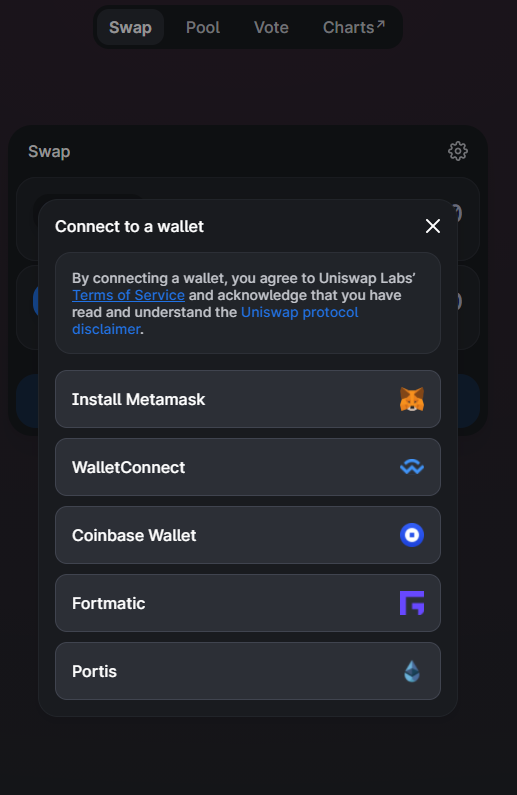

Uniswap connects to the wallets in the screenshot below:

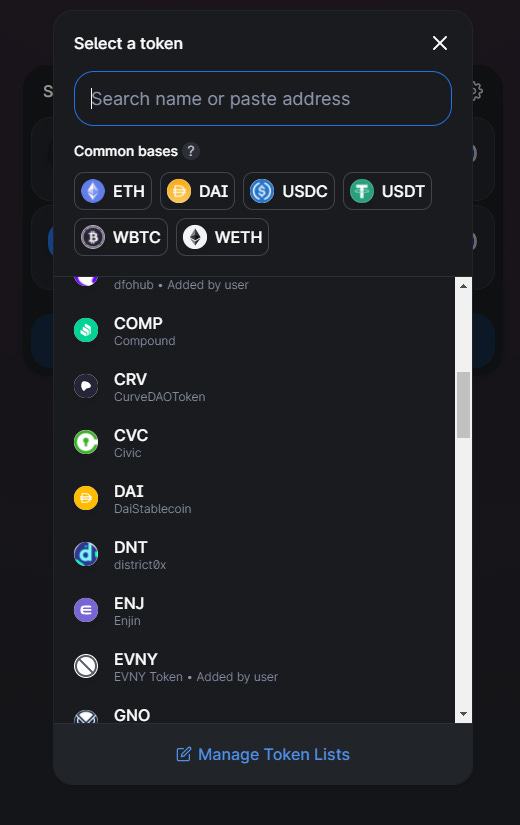

Uniswap only uses ERC20 tokens to exchange with other ERC20 tokens. There are some solutions available for coins that aren’t ERC20. Let’s say you wanted to deal with Bitcoin (which is not ERC20) on Uniswap. You could use Wrapped Bitcoin(WBTC), an ERC20 token which is a synthetic equivalent to actual BTC. More likely in DeFi you’d want the stability of a stablecoin, such as DAI. This of course is pegged to US$.

Automated Market Makers (AMM) & Liquidity Pools

A basic AMM liquidity pool would consist of 2 different tokens, but an equal value of each(50/50). So if the price of ETH was $3000 USD, and it was matched with DAI ($1 USD), then we might have a liquidity pool of 10 ETH and 30,000 DAI. This would be an equal value of $30,000 USD for each half of the liquidity pool. Designed to rebalance to equal halves every trade

LPs would use this same ratio of ETH:DAI when adding and removing their portion of the pool. They’ll be given separate liquidity tokens stating what percentage of the pool they’ve contributed at that moment in time. These LP tokens will then be used to redeem their original funds at some point in the future too. They may even be able to use these liquidity tokens in other ways, such as yield farming, trading, staking, but they’ll need to retain them if they ever want to get their original contribution of ETH/DAI back out of the pool and into their wallet.

The LP tokens act as shares and a receipt of their original transaction with the liquidity pool. A sort of digital IOU (These are not to be confused with the native/governance token UNI please note).

When traders come to buy tokens from the pool, they will pay a 0.3% fee on Uniswap V2 which is distributed proportionately to the LPs. UNI governance ( a decentralized treasury) may also take 0.05% of that leaving LPs with 0.25% of the trade. If this feature is turned on, it’s done in the name of supporting the decentralized community being created and it’s future successful existence. This is done to benefit all including the LP’ers.

AMMs use the decentralized marketplace forces to adjust the ratio of ETH to DAI in the pool. In our example, if someone buys 1 ETH out of the pool for 3000 DAI, we’ll now have 9 ETH and 33,000 DAI (excluding the fees for simplicity). The total value of the pool remains the same, in this particular example $60,000 USD. But the individual price of each token will be adjusted based on supply and demand.

If the price/value of 1 ETH were to reduce to $2500 USD on the open market(any other CEXs/DEXs) as people trade on Uniswap the price will gradually rebalance and readjust the percentage of each token within the pool, to reflect the changes in price.

In some circumstances it may even create an arbitrage opportunity. If opportunistic arbitrage buyers/bots notice this, which they eventually will, they could now take advantage of a price difference between Uniswap and another exchange. In our example, if a trader/bot could buy 1 ETH on another exchange for $2500 and then sell the ETH for $3000 DAI on Uniswap then there would be profit available until the price stabilizes in line with the broader market pricing of $2500.

Here there would be less DAI and more ETH, but the combined value of the liquidity pool will always equal $60,000 USD, regardless of the market volatility and price fluctuations taking place. The only time the total value of the pool changes is when people add or remove their liquidity.

Impermanent Loss and Risks

So now you understand the basic principle of what a liquidity pool is then we need to introduce you to something quite important and explain why Liquidity Providing isn’t all it’s cracked up to be with the most common 50:50 pools.

With impermanent loss a situation arises where the $ value of the LP’s ETH/DAI may in fact be lower than if you would’ve just held on to it in your own private wallet, even when taking into account your share of the accumulated 0.3% trading fees. However, it’s called impermanent because you only will truly realize that loss if you remove your share of the funds from the pool and give back your LP tokens(which are then burned upon redemption). The impermanent loss becomes permanent in this case.

But if you keep your funds in the liquidity pool until the price stabilizes back to its original price then you could take your funds out, plus any fees from the pool on top of your original investment as reward for providing liquidity to the pool. You will not have suffered any loss. Hopefully that shows you why it’s called “impermanent” in the first place...however this is a risk that should be greatly studied and considered should you decide to be an LP one day.

CadiaGem 1. ‘When using Uniswap V2 or any AMM which uses 50:50 pools only provide liquidity for pairs of equal value (or minor difference)’

Here’s the list of protocols where you may be able to find these opportunities on Ethereum(E.g. ETH:sETH DAI:USDT USDC:BUSD):

Aave - Open Source Liquidity Protocol

By only providing liquidity to pairs of equal value you are mitigating the risk of impermanent loss but still able to gain your percentage of the daily trading fees. Sometimes the daily volume on these pairs is still in the tens or hundreds of millions. This is the way to make LPing as stress free as possible. But what if I was to tell you there’s something else to look forward to.

You’ve probably heard of the term ‘Yield Farming’ before. We’ll be going into details about how you can benefit from Yield Farming in a future edition. But for now it’s important that you understand the basics about how it all works.

Some of the golden rules are to learn techniques to protect your capital and be aware of the potential risks. Until DeFi matures then there are still potential risks.

For example if there are faults in the original code or if teams are corrupt and ‘rug pull’. Even billionaire investors like Mark Cuban have been on the wrong side of these unfortunate situations.

For basic LPing best stick to projects that have been around a long time, have many users, and more info about the team and history of the project is available. The projects listed above fit the bill for safety and security very well.

Remember to be rewarded and reach your Crypcadia you must be brave, but still maintain your awareness.

Variations, Bancor, Balancer:

Note that not every liquidity pool will stick to the exact 50/50 format. There are 4 main categories:

Liquidity pools with two volatile assets, example ETH/WBTC

Pools with 2 equally valued assets like ETH/sETH, or stablecoins like USDC/DAI

A DApp like Bancor offers “single sided liquidity”, where you would mitigate exposure to impermanent loss by only contributing one token

A DApp like Balancer, where one pool could have up to 8 different types of crypto in custom percentages (E.g. 33% ETH/33% WBTC/33% DAI or 40% USDC/20% USDT/15% DAI/15% ETH/10%WBTC)

Uniswap V3

CadiaGem 2. ‘Utilize concentrated liquidity for capital effficiency’

In March of 2021 Uniswap introduced the V3 upgrade on the Ethereum mainnet. The biggest upgrade was the concept of concentrated liquidity. Essentially concentrated liquidity lets you set a price range for which your token will be traded at within a liquidity pool. This will mitigate your exposure to impermanent loss. So you could specify that your ETH would only be traded and available within the pool at $4200-$4300 USD. Above or below that range your ETH will remain dormant until the market returns to your set price range.

So this is all about capital efficiency….

Uniswap V3 also added some options to adjust their standard swap fee from V2 further customizing each liquidity pool to 0.05%, 0.3% or 1%. This would allow LP’ers to further customize their liquidity pools and tailor it to the LPs and traders. For example, a USD stable coin pool could charge the lower 0.05% fee, as there is not much price changes happening in those pools (usually between $0.99-$1.01). This will also further motivate traders to use those pools because of the lower fees and brings them into line with Curve Finance.

As well, in Uniswap V2 a flat governance fee of 0.05% could be turned on by UNI governance (the UNI token holders). In V3, a range of protocol fees can now be customized and turned on by UNI governance which makes sense on a pool by pool basis. Between 10-25%.

So expect larger more successful pools to incorporate higher swap fees collected by the protocol. This will affect LPs more than traders of course, as LPs would see a lower percentage per trade, however they may take this into account when deciding on the now customizable swap fees.

In V3, the formerly ERC20 based LP tokens are now NFTs. This is because there is more custom information to be stored with the more unique type of liquidity pools that are being created due to concentrated liquidity and customized fees.

With the addition of concentrated liquidity, there is the scenario in which you’d need to really pay greater attention to the token prices and market conditions and be more active than just leaving your funds in the liquidity pool with your initial entry set as in V2.

You might notice that the price of ETH has gone up to $4400 USD, and decide to adjust your price range accordingly, from $4000-$5000 for example. That way you could be benefiting from the higher market price along a wider range, and keep collecting fees. But to truly get the most out of your liquidity and be even more capital efficient by just setting the range in a small percentage you would need to be constantly changing the range every time the price went up or down.

But here’s the caveat- every time you change the range there are going to be gas fees to pay.

Gradually there is migration of liquidity onto Ethereum Layer 2’s such as Arbitrum and Optimism. Be early because...

Ethereum Layer 2’s Are Hot - Crypcadia (substack.com)

In the above article we took a closer look at these to help you find the best opportunities. Now there’s less impermanent loss to watch out for with V3 concentrated liquidity then we just have to avoid the high gas fees on the Ethereum base layer to make it a profitable enterprise.

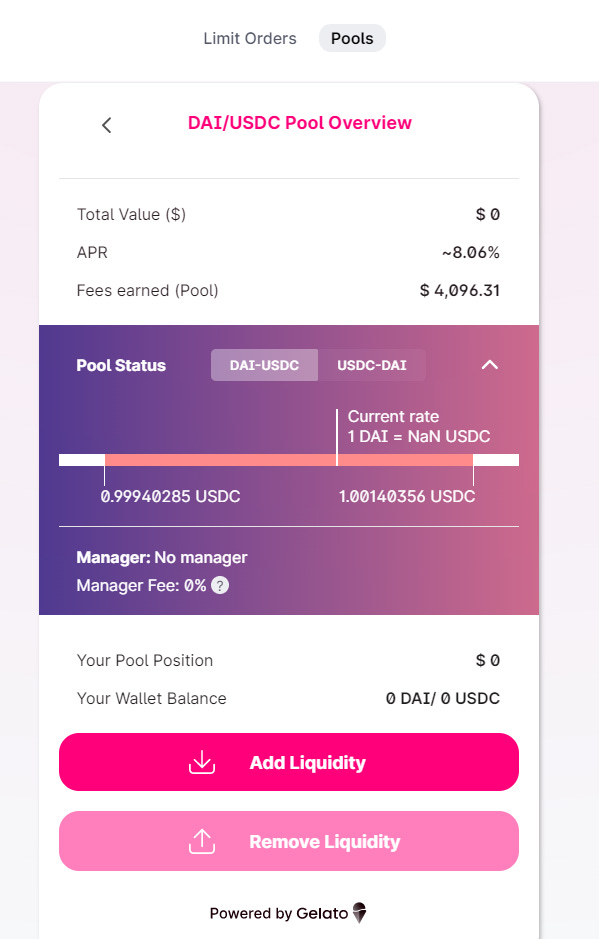

CadiaGem 3. ‘Hosted Options to Assist Your V3 LP!’

There are hosted services out there to explore should you not have the time to pay attention to your Uniswap V3 liquidity pools often. If you’re comfortable you can research these options and decide if they are right for you. Think of these as “pool managers”. At Crypcadia we have experience and use of Visor and Gelato, both of which we feel positive about. Visor displays expected APYs and makes managing LP positions a breeze.

xToken and Charm Finance are two others protocols but their allocations were full last time we checked. As always please DYOR- do your own research before using any new protocol.

Visor Finance - Active Liquidity Management on Uniswap v3

Gelato - Automated smart contract executions on Ethereum

Hopefully this gives you an idea of the evolving DeFi options at your fingertips currently, and where everything is going in the future (Hint: Layer 2’s!). Despite the turbulence to watch out for on the voyage, it’s one of the most exciting, innovative and transformative DeFi concepts in all of crypto, so best buy your ticket now and join us on the Path to Crypcadia!